Diversification is second nature when it comes to equities, but many investors still anchor their strategies to a narrow slice of the market in fixed income. This strategy could mean missed opportunities and hidden risks. From large institutions to individual retirees, billions of dollars in investor portfolios are linked to the Bloomberg U.S. Aggregate Bond Index (the Agg).

However, tracking the Agg has some notable drawbacks. Investors who rely solely on the index may be overlooking valuable opportunities in assets that offer greater diversification beyond the benchmark.

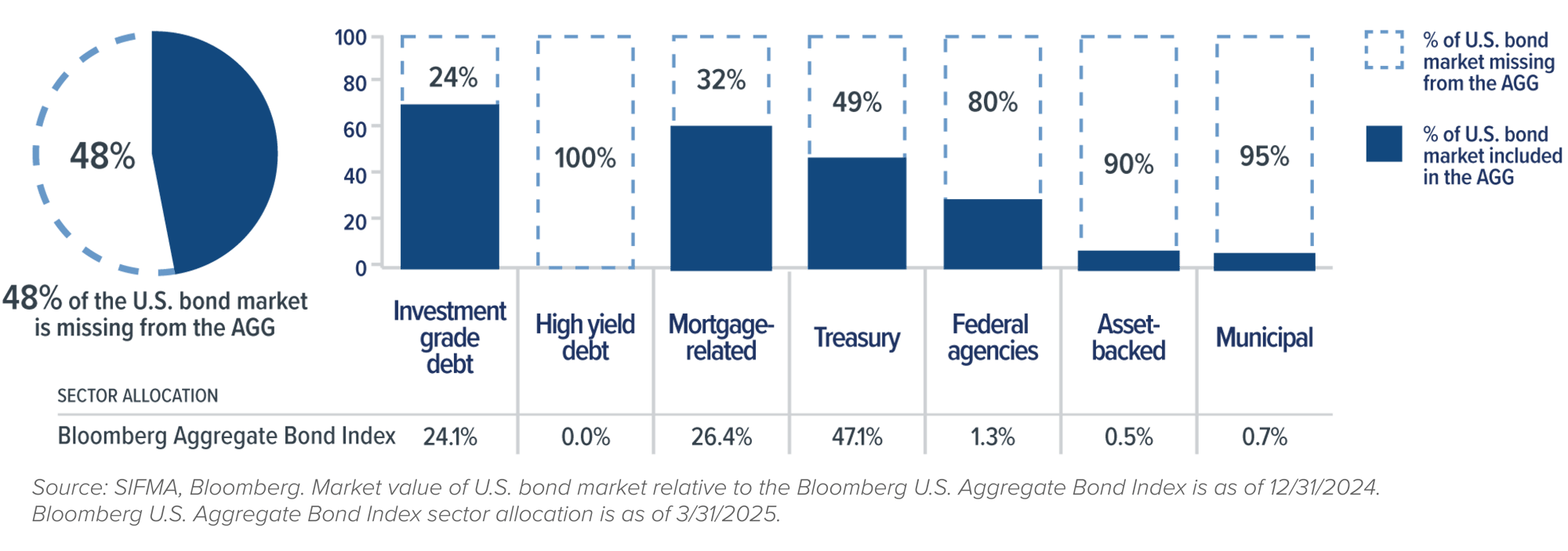

When it debuted in 1986, the Agg was a fair snapshot of the U.S. bond market. But times have changed. Today, it covers approximately half of the investable U.S. bond universe, excluding entire sectors offering compelling income and diversification potential.

Because the Agg is market-cap weighted, it gives the most weight to the largest borrowers—mainly the U.S. government. Factoring in U.S. Treasuries and U.S. government-backed mortgage-related securities, more than two-thirds of the Agg’s holdings are in government debt, limiting its diversification effects for investors.

What’s left out of the Agg?

- Excludes bonds with less than one year until final maturity

- Issuers with less than ($300 million outstanding for Treasury, government-related, and corporate securities; $500 million deal size for ABS and CMBS)

- Securities that are not fully taxable and do not have a fixed-rate coupon structure

As a result, the Agg’s scope is quite limited.

Casting a wider net through active management can create opportunities.

By looking beyond the Agg, investors can access a more complete opportunity set from securitized credit to niche corporate bonds. This helps investors build portfolios that are more resilient, better diversified, and more attuned to changing market dynamics.

Our portfolios invest across the broad fixed income market wherever we see valuable risk/reward opportunities. This typically results in a portfolio that’s not correlated to the Agg, though at times, the market warrants that the portfolio may incidentally look more like the Agg if those are the best opportunities at the time.

In an evolving fixed income market, flexibility is key to weathering any storm. Today’s investors can’t afford to “set it and forget it”—active, diversified strategies are more essential than ever.

Click below to learn how our strategies put this approach into action.